jersey city property tax delay

I did get an email from Jersey City OEM about it. Jersey City last conducted a citywide revaluation its first in 30 years in 2018.

How The Mayor Stuck Wards A B C And D With 143 Million In Taxes

PAY PROPERTY TAXES Online In Person - The Tax Collectors office is open 830 am.

. In the past year Ive also written about tax appeals and I also served on a team of Jersey City Together volunteers in 2017 that helped over 30. Jersey city property tax delay Thursday March 3 2022 Edit Ireland is on all academic tax haven lists including the Leaders in tax haven research and tax NGOsIreland does not meet the 1998 OECD definition of a tax haven but no OECD member including Switzerland ever met this definition. A driving factor is the market growth of Jersey Citys taxable real estate.

Effective June 4 2021 Governor Murphy rescinded the Public Health Emergency PHE. Jersey City hasnt set a date for when tax bills will go out. Property tax credit delayed.

On April 4 2016 the New Jersey Treasury ordered Jersey City to complete a tax revaluation by November 1 2017 with new values to take effect for the 2018 tax year. But Cerra warned the municipalities that act as a tax collector for school districts and counties would bear the brunt of delayed payments. Jersey City Property Tax Appeals.

The final rate of 148 has been officially certified by the board a tad below the 162 estimate that had been given to residents. City of Jersey City. In New Jersey localities can give.

On March 9 2020 Governor Murphy issued Executive Order No. Monday August 7 2017 103802 AM EDT Subject. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST.

However the State of Emergency continues and has not been rescinded. TAXES PAYMENT 000 50000 000 0 000. A Civic Step-by-Step Overview.

City of Jersey City PO. JERSEY CITY NJ 07302 Deductions. NJ freezes nearly 1B in programs to deal with coronavirus.

The order followed an investigation from the state a series of escalating statements from the treasury and accusations of personal and political agendas in the mix. Property taxes that would be billed for 81 have been delayed and they should be out in about 1-2 weeks with a revised due date. Rather the issuance of bills was delayed pending.

Close to 1 billion in state spending was frozen Friday as an effort to keep the state afloat amid the. Your account will remain at the 18 threshold until it is brought current. PROPERTY TAX DUE DATES.

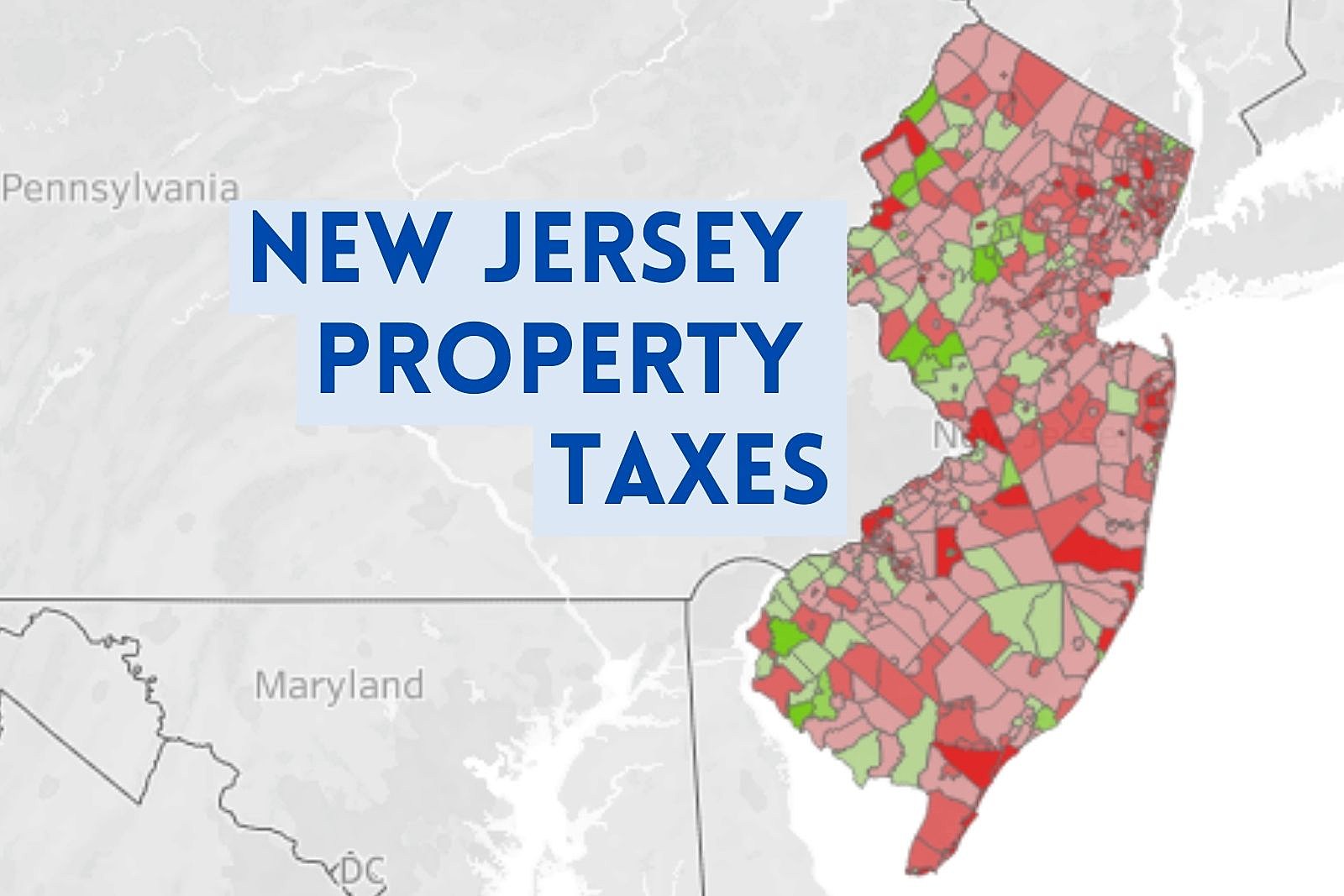

For the past 4 years Ive been researching and writing about property taxes and revaluation among other topics on CivicParent. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Meanwhile they have their own employees to pay.

Online Inquiry Payment. The school board here adopted a budget amendment last night to make up for the 84. New Jersey will follow the extended federal due date and eligible taxpayers who were victims of Hurricane Ida will now have until February 15 2022 to file returns and pay any taxes that were originally due starting on August 26 2021.

Because its been so long and so much has. The administration did not issue estimated tax bills in 2021 as what has been done in the past. Due to changes made by the State of New Jersey to the awarding of State Aid to the school districts.

NJ law states that property should be assessed. Each business day By Mail - Check or money order to. 103 declaring both a Public Health Emergency PHE and a State of Emergency.

Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. City of Jersey City - Delayed Tax Bills The 2017 final tax bill has not yet been mailed. Interest in the amount of 8 per annum is charged on the first 150000 of delinquency and 18 per annum on the amount over 150000.

Assemblyman Robert Karabinchak D-Middlesex filed a bill Thursday to delay the May 1 due date to July 15 when state and federal tax returns are now due for commercial and residential properties. Phil Murphy D signed an executive order allowing municipalities to extend the grace period for property tax payments from May 1st to June 1st Jersey City will allow their residents to take advantage of this offer. Box 2025 Jersey City NJ 07303.

But some good news came courtesy of Hudson Countys tax board last week as Jersey Citys property tax rate came in lower than expected. The Garden State is home to the highest levies on property in the nation with a mean effective property tax rate of 221 according to the Tax Foundation. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes.

Jersey City is going through what they call here a reval where for the first time since 1988 homes are being re-evaluated for property tax purposes. Property Taxes are delayed. Jersey City Property tax payments received after the grace period interest will be charged.

Property Taxes are delayed. But property tax data published in October 2019 by the NJ Division of Taxation reveals Jersey City may once again be approaching the need for another revaluation. Jersey City taxpayers would normally be granted a 10-day grace period to pay their tax bill meaning you could pay your taxes until August 10 th if it was issued on August 1 st without being hit with interest charges for the late payment.

The Ten Lowest Property Tax Towns In Nj

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com

The Ten Lowest Property Tax Towns In Nj

Jersey City New Jersey Property Tax Revaluation 2016 Ballotpedia

The Official Website Of The Borough Of Roselle Nj Tax Collector

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 New York

The Ten Lowest Property Tax Towns In Nj

Santa Clara County Ca Property Tax Calculator Smartasset

The Ten Lowest Property Tax Towns In Nj

The Ten Lowest Property Tax Towns In Nj

Jersey City New Jersey Property Tax Revaluation 2016 Ballotpedia

City Of Jersey City Online Payment System

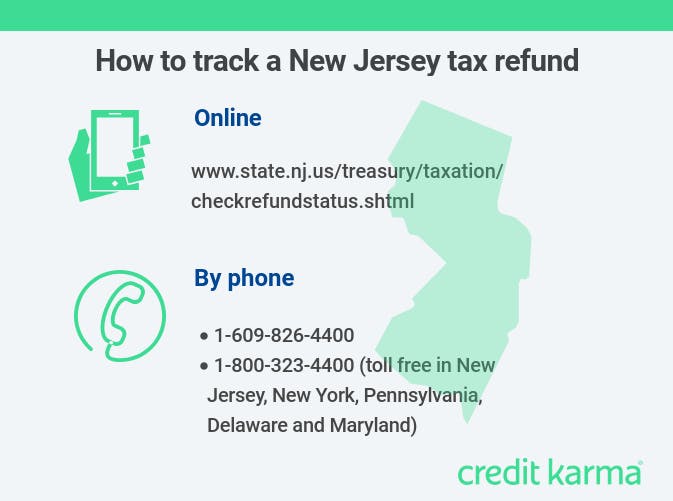

Where S My Refund New Jersey H R Block

Avoid 6 Mistakes That Will Delay Your Irs Tax Refund